An image from Louis Delannoy's thesis presentation at the INRIA in Grenoble on Sep 15, 2023. Louis (you see him at the bottom left of the picture) worked on modeling the energy transition using models that took EROEI (energy return of energy invested) explicitly into account. The results are in line with what we already know: the transition is possible but not easy. However, Delannoys' approach to the calculations led to several interesting insights. One is about how tight oil revolutionized the oil market in the 2010s. It turns out that shale oil was a small technological miracle. Can it be repeated? A crucial question for the future of humankind. The following text is inspired by Delannoy's thesis, although it reports personal reflections of mine.

"Game Changer" is an abused term, but it perfectly applies to the impact of fracking on the oil market in the 2010s. While the experts mostly agreed that the decline in the US oil production was definitive, unexpectedly, the market was flooded with the new "tight oil" or "shale oil" produced by "fracking," which by now exceeds the production of conventional oil in the US by a ratio higher than 60%/40%. Tight oil production is still increasing in the US, and it may continue increasing for at least a few years, although at increasing extraction costs. (image source)

The success of the tight oil operation raises several questions: Why was it so successful? Why didn't it arrive earlier? Why wasn't it predicted? How long will it last? Can it be replicated outside the US?

The biophysical view of oil extraction assumes that the "easy" resources (that is, the low-cost ones) are extracted first. These are the resources that provide the highest EROI (energy return for energy invested) and those that provide the highest economic return. As these resources are depleted, the extraction effort moves to lower EROI and hence more expensive resources. Prices must be increased to maintain profit, and that negatively affects the demand. The result is the familiar, bell-shaped "Hubbert Curve." (here seen as an illustration from the original 1956 paper by Marion King Hubbert).

It was because of this view that, in the 2000s, many energy modelers tended to dismiss shale oil as a short-lived fad. When the industry started extracting it the reaction was that, since shale oil came much after the start of the decline of conventional oil, it must be a last-ditch attempt to extract from low EROI resources. Indeed, the complexity and sophistication of the machinery needed for the various operations of shale oil drilling are impressive. You would think that the whole Rube Goldberg machine is inefficient and expensive, an impression reinforced by the multiple statements in the financial media that investors mostly didn't make any money on fracking.

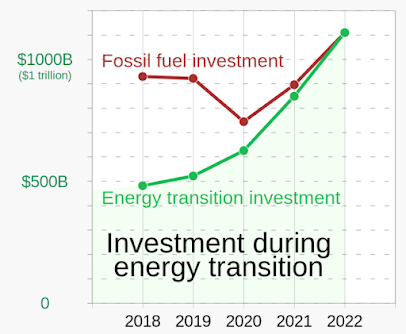

But that doesn't seem to be the case. Take a look at the table at the beginning of this post. While conventional crude in the US now has an EROI of around 10 at the wellhead, the estimate reported by Delannoy

from a paper by Brandt et al. is around 30 for shale oil, again at the wellhead. Do not place too much trust in these numbers; they are affected by large uncertainties. But they go straight in the face of the simplified biophysical model that sees extraction moving smoothly from high EROI to low EROI resources.

So, what's happened? Well, it is one of the rules of the universe that "

God chooses the foolish things to confound the wise (

1 Corinthians 1:27). The wise, aka the "experts," tend to focus on what they know and dismiss what they don't know.

The record of experts in understanding technological revolutions is extremely poor. In the energy field, they tend to put a lot of trust in "new technologies," but almost always, they bet on the wrong ones, e.g., hydrogen. In parallel, they miss the true revolutions, such as shale oil.

Even recently, experts are totally unable to believe or understand the new game-changer, photovoltaic energy, which now has an EROI large enough to trash all fossil alternatives. Most experts are not familiar with photovoltaic technology. They just cannot understand how an apparently simple gray slab can compete and outmatch the giant steam turbines operated by a huge nuclear plant. Fortunately, efficient technologies tend to affirm themselves by the pure force of their efficiency. It happened for shale oil; it is happening for photovoltaics. We are watching changes happening even though we often don't understand them. As usual, the future decides for us.

______________________________________________

A few more points to consider

1. The rise of tight oil is sometimes used to po-pooh biophysical modeling and the Hubbert curve. That's a bad mistake. The biophysical model is good, it is perfectly describing what happened in the US during the past 20 years if you take into account the high EROI of shale oil. Technology is one of the factors that can change the game: airplanes do not invalidate Newton's universal gravitation law.

2. Tight oil was a success, but that doesn't mean it is a good thing, nor that it will last forever. It keeps us dependent on liquid fuels and postpones the badly needed transition to renewable energy. Fortunately, even this high-EROI resource can't last forever. Despite some optimistic claims of "centuries of prosperity," it is likely to peak and start declining in the coming few years.

3. The story that investors didn't make any money on shale oil is a little more difficult to understand. If shale oil has such a good EROI, how can it be that people didn't profit from it? Tentatively, it can be explained by assuming that profits were nearly completely reinvested into new drilling. Note, indeed, how steep is the growth curve of shale oil production. Apparently, investors have been waiting for shale oil to gain a stable place in the market before starting to go for profits. We read in financial journals that most investors declared that they are now stopping to pour money into new shale wells, focusing now on maximizing profits. It may be one of the reasons for the recent rise in our prices,

3. It is a good thing that the EROI of liquid-producing technologies alternative to shale oil, such as Coal to Liquids (CTL) and Gas to Liquids (GTL), have such a low EROI (look at the image from Delannoy's thesis above). It means that when tight oil starts declining, we won't see a rush to synfuels (thanks, God!). We may see an attempt to move to tar sands, but even in that case, the EROI is probably too low to repeat the shale oil miracle.

4. There remains an open question in a geopolitical context. Why is it that tight oil is extracted only (or almost only) in the US? Clearly, the US industry has developed efficient technologies for horizontal drilling and hydraulic fracturing. But these are not so complex that they cannot be replicated elsewhere, and the US industry itself may be interested in applying them in other countries. So, why, for instance, isn't Russia developing the

Bazhenov Formation, located in western

Siberia? According to the

U.S. Energy Information Administration, the total Bazhenov shale prospective area has tight oil resources of more than one trillion barrels. Maybe it is an exaggeration (these estimates often are), but it is a huge amount that corresponds to about 30 years of consumption at the current rates. There are many other potential resources of tight oil in the world but none is exploited at a significant rate. This geopolitical game is destined to remain a mystery for now, and we can only hope that the photovoltaic revolution will soon make liquid fuels obsolete.

Louis Delannoy at his thesis discussion on Sep 15th, 2023, in Grenoble. He wears a "Limits to Growth" t-shirt (you can buy one yourself on Zazzle).