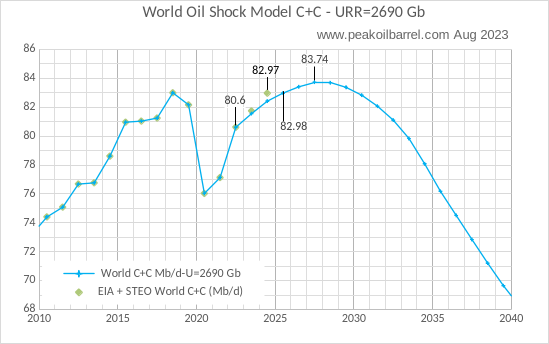

The updated peak oil model proposed by Ron Patterson in his blog. The data are in million barrels (Mb) per day. Production stubbornly refuses to decline, and we may have a few years more before it finally peaks and starts going down.

Fossil fuels stubbornly refuse to die. The latest data reported in the excellent site "Peak Oil Barrel" summarizes the situation as it is now. The world oil production of "crude + condensate" (C+C) has nearly returned to the pre-COVID levels, may surpass them in 2025, and keep growing until 2028. Note that this is "conventional" oil; if we include "all liquids," and in particular tight oil, the amounts produced increase, but the peak date doesn't change much.

These data show that the global production of liquid fuels may stay for a few more years at levels near 100 Mb/day. Not only may oil production remain at the highest levels ever seen in history, but the same is true for the other two main fossil fuels: coal and natural gas (you can see some recent data in Gail Tverberg's blog).

At the beginning of the current century, it was believed that geological and economic constraints would lead to reaching the maximum oil production ("peak oil") before the end of the 2nd decade of the century. But those estimates didn't consider how desperate the need for liquid fuel was. The result was an ace up the sleeve called "tight oil" or "shale oil." It was unexpected: most experts thought that shale oil was too expensive to have a role in the market. It didn't matter: shale oil production was financed and supported even though it required enormous investments in terms of resources. As a result, oil prices rose to levels considered unthinkable a few decades before, incidentally beggaring a large number of people. Among other things, shale oil allowed the United States to keep playing the Emperor of the Hill.

How about the future? What we see in Patterson's graphs are model-based extrapolations with all the uncertainties involved. In particular, the model considers a symmetric production curve, with the decline mirroring growth. But that's not necessarily true. Any global shock, such as another pandemic, a major financial crash, or a large war, could cause production to plummet rapidly, giving the curve the "Seneca Shape" -- that is, with the decline much faster than growth.

On the other hand, we cannot exclude another parting shot by the fossil industry. After seeing what they could do with tight oil, we cannot dismiss the possibility of a move to synthetic fuels manufactured from coal. The technology is known; coal is still relatively abundant, so it could be done. That would be a true Derringer up the sleeve, leading to several more years of production of liquid fuels at the current level.

We have to face reality: the naked apes of planet Earth are not going to give up their addiction to crude oil. Not so soon, anyway. Dire climate scenarios, international treaties, or individual goodwill do not seem to affect the attempt to keep producing fossil fuels as much as possible, as fast as possible, up to the last drop of oil or the last lump of coal. Indeed, governments are specializing in a form of doublespeak that they use to proclaim that they care about reducing carbon emissions while at the same time encouraging the fossil industry to produce more ("green coal," anyone?)

So, what's going to happen? One possible scenario is that we simply keep going along the curves of Patterson's models. In this case, we have at least a few more years left to keep the world's economic system alive, even though ordinary people will all be progressively poorer because of the increasing energy costs to produce energy (declining EROI). Nevertheless, that could result in a certain degree of stability that would allow the deployment of a significantly large renewable infrastructure. In some 30 years projections indicate that it would be possible to sustain the global economy (or a smaller version of it) wholly on renewable energy. Would that be fast enough to save us from the collapse of the ecosystem? Probably not, since the collapse is already ongoing. In the case of a rush to synfuels, then, an ecosystemic collapse would be surely unavoidable. Besides involving a disastrous increase in carbon emissions, synfuels would subtract precious resources from the task of building a renewable infrastructure. In this case, the Derringer up the sleeve would be used to shoot oneself.

Another scenario involves the deployment of geoengineering on a massive scale to avoid the most damaging consequences of global warming on the economy. The uncertainties are enormous, but, if it were to work, it would give humankind some time to apply the "Sower's Strategy," allocating a sufficient fraction of the remaining fossil energy to the move to renewables.

There are other possible scenarios: one is the "transition to panic," according to Schlesinger's principle ("humans have only two modes of operation: complacency and panic"). Panic could be generated by growing evidence of the ongoing climate catastrophe. That might finally lead to a serious effort to curb the use of fossil fuels or, more likely, to more sophisticated doublespeak about green coal. Conversely, panic about a collapsing economy could lead to a backlash against renewable energy, accused of being the culprit of whatever disaster befalls humankind. After reading comments of people seriously claiming that induction stoves have been purposefully designed to starve them to death, anything can happen. And that, obviously, would lead humankind straight into a climate catastrophe.

As usual, the future is uncertain and always surprising. The only certain thing is that we are going to see enormous changes, and those changes may be bad, but they are also opportunities. The "Seneca Cliff" always involves a "Seneca Rebound" that may allow us to shape human society in a way that does not fight the ecosystem but adapts to it: the "Sunflower Paradigm."